The digital economy is spurring dramatic new ways to look at markets, profits, and value.

Two MIT researchers, Seth Benzell and Avinash Collis, are among those studying how new technology providers are impacting the economy and driving changes to traditional metrics and markets. Each shared their work at a recent IDE seminar.

At a time when Facebook and other social media platforms are under scrutiny for their enormous clout, the research explores the welfare effects of digitization. Specifically, Collis, a doctoral candidate at the MIT Sloan School of Management and a researcher at the MIT Initiative on the Digital Economy (IDE), examined just how valuable social media has become to users.

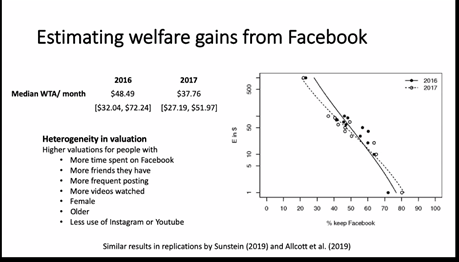

In a much-cited recent study, GDP-B: Accounting for the Value of New and Free Goods in the Digital Economy, Collis — working with MIT IDE Director, Erik Brynjolfsson and three other researchers — discovered that digital goods generate a large amount of consumer surplus that is currently not captured in GDP. The most provocative question raised in the study was how much compensation it would take for Facebook users to give up the platform for a month. The answer: around $48. Building on these results, the team extended the GDP framework to include welfare gains from new and free goods and constructed a new metric called GDP-B, where B stands for benefits. (Read more on the study here.)

The inclusion of welfare gains from Facebook and other digital platforms into the GDP is significant — adding between 0.05 and 0.11 percentage points to GDP-B growth per year in the U.S., Collis said. The researchers also ran randomized controlled trials to measure the impact of social media on subjective well-being, and compared and contrasted different measures of consumer welfare in the digital economy. The results can be found in this research paper, Using Massive Online Choice Experiments to Measure Changes in Well-being.

In general, GDP-B shows that new ways to account for the value of digital goods — such as free services and smartphones — might more accurately reflect their value, according to Collis. Welfare gains and benefits from these goods are poorly captured in today’s GDP.

One important implication of the GDP-B research is for antitrust in the EU and the U.S., he said. For instance, Facebook’s acquisition of WhatsApp was allowed by EU regulators because they agreed that the two services operate in different markets and “are often direct competitors.” On the other hand, the proposed integration of Facebook, WhatsApp, and Instagram accounts “will massively increase their market power and should be cause for concern for antitrust authorities.”

Among the conclusions Collis shared at the seminar are the following:

- GDP remains the de factor metric of economic growth. However, consumer surplus is a better metric of economic well-being than GDP.

- Massive online choice experiments have the potential to reinvent and significantly supplement the measurement of economic welfare.

- We need a dashboard of metrics including GDP-B, subjective well-being, and GDP, to inform the decisions of policymakers.

(Additional reading on the topic can be found in this new Harvard Business Review article, How Should We Measure the Digital Economy?)

Taxation and Regulation

Seth Benzell, a postdoctoral associate at the IDE studying Productivity, Employment, and Inequality, spoke at the seminar about the complexities of trying to tax and regulate digital platforms. While he noted that there are increasing calls for regulation, no one has estimated how these policies would change consumer welfare.

Benzell and Collis developed a model of digital platforms to provide new insights for regulators and platform managers based on large-scale choice experiments of 40,000 American Facebook users. The results of the study — simulating and testing six proposed government policies for digital platforms — are described in the paper, Multi-Sided Platform Strategy, Taxation, and Regulation: A Quantitative Model and Application to Facebook.

The three tax and redistribution options Benzell considered are: A tax on ad revenue; user taxes, and a data-as-labor model where users are reimbursed based on ad revenue.

Each option has tradeoffs to consider. “If we place a tax on the number of users, it can raise a large amount of revenue, but Facebook will respond by squeezing its most inelastic consumers more. This lowers consumer welfare both directly and indirectly by reducing the number of users and positive network effects,” Benzell said. Alternatively, if ads are taxed, it could incentivize Facebook to reduce the level of advertisements and focus on growing the user base. In the third option, rebating ad revenue would boost consumer welfare and increase network effects.

Similarly, the researchers tested three regulatory options: Perfect competition; a breakup of Facebook, and nationalization for social-welfare maximization. Among Benzell’s key conclusions are:

- Facebook today creates ten times as much consumer surplus as it makes in profit.

- Facebook is relatively inelastically supplied, so taxes tend not to move consumer welfare very much.

- Regulatory intervention can be risky. Optimal regulation would raise consumer welfare by 42%, while a poorly executed breakup could lower consumer welfare by 44%.

The optimal solution for Facebook may not be same for users, of course. Reaching the right balance is what all platform companies, regulators, and stakeholders have to weigh when they consider pricing and growth strategies, according to Benzell.