Two of the biggest questions related to AI and robots today are how much we should embrace these new technologies and how government policy should respond. Specifically, many are asking if taxes should be levied on the use of robots to offset their job-displacement effects.

Iván Werning, macroeconomics researcher and the Robert M. Solow Professor of Economics at MIT (in photo above), addressed both of these important topics at a recent seminar at the IDE. Discussing a new working paper, “Robots, Trade, and Luddism: A Sufficient Statistic Approach to Optimal Technology Regulation,” Werning offered a model and formula for evaluating the impact of technology and the optimal tax on it. His research with MIT’s Arnaud Costinot, examines whether taxation or protectionist trade policies — like those being discussed in the U.S. and in Europe — might help to better distribute the economic benefits of AI technologies.

Two types of Taxes

While there are many variables, the research examined two types of taxation: on the developers of technology, and on the users or purchasers. The results indicate that very modest taxes on the use of these technologies may be warranted in certain cases, but taxing the innovators or developers of the technology is undesirable because it would impede innovation.

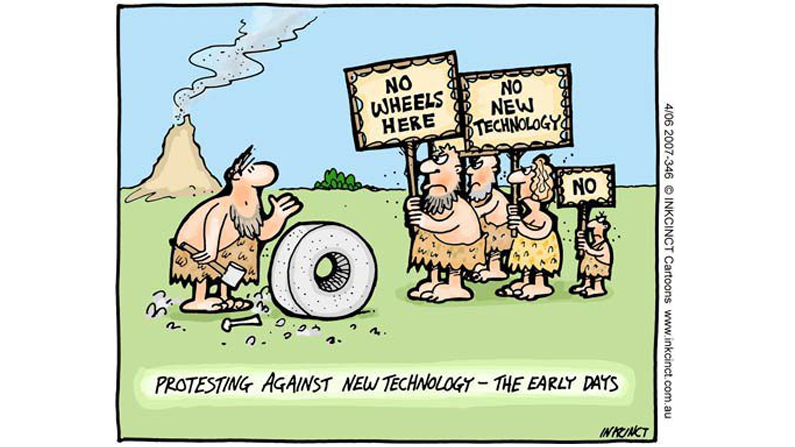

In general, new technologies improve efficiency. This is true even as wage and labor inequality are rising and welfare distributional effects are not offsetting the benefits quickly enough. Werning’s premise is that technological change, “from the advent of robots to expanded trade opportunities, tends to create winners and losers.” From a macroeconomic perspective, he studied whether we should become more like the 19th-century Luddites and limit the use of technologies, or become more protectionist as trade opportunities expand.

The idea of a so-called robot tax gained attention last year when high-profile figures, including Bill Gates, floated the notion of a hefty corporate ‘income tax’ on robot workers to slow the impact of automation and allow governments to balance the scales in favor of human workers.

To date, no tax has been implemented anywhere. It’s been reported that the European Parliament “toyed with the idea but ultimately rejected it, concerned it would amount to a tax on progress and put the EU at a disadvantage.”

The goal of Werning’s paper is to provide a general framework to guide policymakers regarding taxation and technological progress. The framework shows that when policymakers can optimally tax the use of technology, then new technologies are welcome and innovation should not be discouraged. Importantly, they found that a modest tax on the use of technology (as opposed to innovation) may be the optimal prescription. The research provides a formula that can help quantify the desirable level of such interventions, creating a bridge between theoretical and empirical work. Most crucially, the formula requires as inputs estimates of the effect of technology on wages and inequality. The researchers were surprised to find efficient taxes on robots ranging from 1% to 3.7% when they implemented the formula with current estimates — lower than expected.

Future Impact

The researchers also project the implications of their formula into the future. As robots and AI improve and become more widely adopted, should taxes be higher? Not necessarily. In the future, the impact on wages and inequality may be quite extreme requiring more extreme measures. Moreover, “as the process of automation and globalization deepens, more inequality may best be met with lower Luddism and less protectionism.”

In other words, as robots and AI are used more widely, production costs will fall and productivity will rise. At that point, taxing tech firms specifically for robot implementation could impede innovation and competitiveness. Other solutions for income redistribution, such as a universal basic income, may be more effective.

The three major takeaways of the report are:

● Creation of three optimal tax formulas that can be implemented using evidence on the distributional impact of new technologies, such as robots and trade.

● A comparative static exercise illustrating that while distributional concerns create a rationale for taxes on robots and trade, the magnitude of these taxes may decrease as the process of automation and globalization deepens and inequality increases.

● Despite limited tax instruments, technological progress is always welcome and valued in the same way as in a first-best world.